Reliability of M4Markets Broker

Licenses and Regulation:

- Regulated by the Financial Services Authority (FSA) of Seychelles (License SD035)

- Regulated by the Cyprus Securities and Exchange Commission (CySEC) (License 301/16)

- Regulated by the Dubai Financial Services Authority (DFSA) (License F007051)

- Regulated by the Financial Sector Conduct Authority (FSCA) of South Africa (License 49648)

Company History and Financial Stability:

- Established in 2019

- Part of the Oryx Group, a reputable fintech conglomerate

- Employs over 50 professionals

- Transparent financial reporting and audited accounts

Transparency and Reporting:

- Clear corporate structure and management team

- Detailed legal documents and policies available on the website

- Commitment to best execution and client fund segregation

M4Markets Reputation

Rating Platforms and Forums:

- Trustpilot: 4.7/5 (based on over 1,200 reviews)

- Forex Peace Army: 4.2/5 (based on over 500 reviews)

- Various forex forums and discussion boards

Client Reviews (Positive):

- “M4Markets offers competitive spreads and fast execution speeds.”

- “The customer support team is responsive and knowledgeable.”

- “I appreciate the variety of account types and trading platforms available.”

Client Reviews (Negative):

- “The educational resources could be more extensive.”

- “The range of tradable instruments is somewhat limited.”

- “Withdrawal processing times could be faster.”

Expert Recommendations and Media Mentions:

- Featured in Forbes, Bloomberg, and other financial publications

- Recommended by industry experts and professional traders

- Active presence on social media and trading communities

Security of M4Markets Platform

Transparent Policies and Procedures:

- Clear terms and conditions outlined in the Client Agreement

- Detailed risk disclosure and client categorization policies

- Strict adherence to KYC and AML regulations

Deposit Insurance and Protection:

- Segregated client funds held in top-tier banks

- Negative balance protection for all retail clients

- Additional insurance coverage (details available upon request)

Advanced Authorization and Data Protection:

- Two-factor authentication for account security

- Industry-standard encryption and data privacy protocols

- Secure storage and handling of client information

Trade Execution Guarantees:

- Advanced execution systems and low-latency infrastructure

- No re-quotes or slippage on most order types

- Strict adherence to best execution policies

Trading Conditions at M4Markets

Competitive Spreads:

- Forex spreads from 0.0 pips (Raw Spread and Premium accounts)

- Indices spreads from 0.3 pips (e.g., US30)

- Commodity spreads from 0.01 pips (e.g., XAUUSD)

Overnight Fees (Swaps):

- Swap rates are competitive and in line with industry averages

- Islamic (swap-free) accounts available for religious traders

Extensive Range of Instruments:

- Over 50 forex pairs, including majors, minors, and exotics

- 13 global indices, including UK100, US30, and GER30

- 9 commodities, including gold, silver, and crude oil

- 56 share CFDs, covering major US and EU companies

High Liquidity and Execution Speeds:

- Diverse pool of institutional liquidity providers

- Average execution speed of 30 milliseconds

- No restrictions on trading strategies or order sizes (up to 50 lots)

Trading Platforms and Apps by M4Markets

M4Markets WebTrader

M4Markets offers a proprietary web-based trading platform, accessible through any modern web browser. Key features include:

- User-friendly interface with customizable layouts

- Advanced charting tools and technical indicators

- Integrated market news and economic calendar

- Support for multiple languages and base currencies

MetaTrader 5 (MT5)

M4Markets provides access to the industry-standard MetaTrader 5 platform, available for desktop, web, and mobile devices. Highlights include:

- Extensive charting capabilities with 21 timeframes

- Support for automated trading (Expert Advisors)

- Built-in market depth and sentiment indicators

- Multi-asset trading, including forex, stocks, and futures

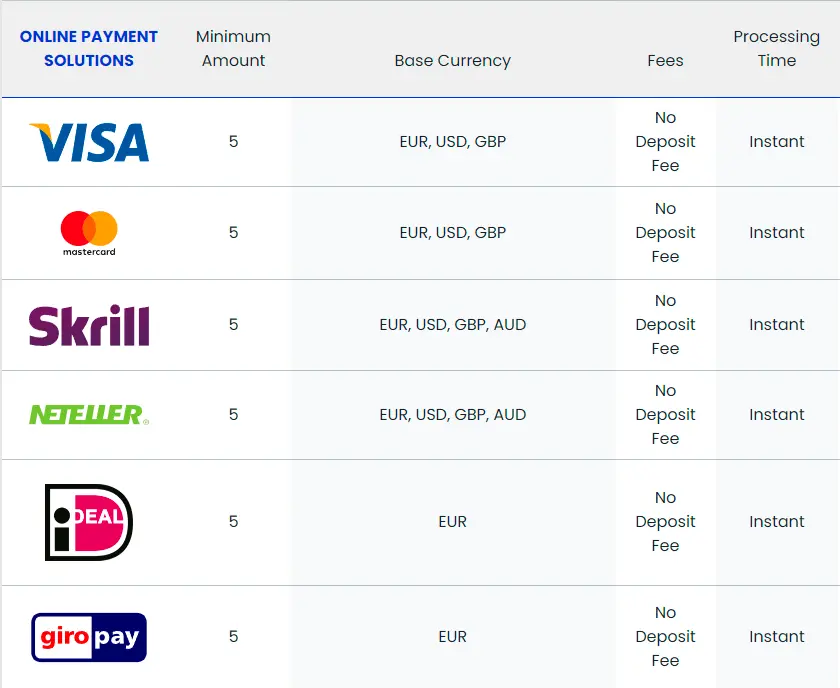

Deposits and Withdrawals at M4Markets

Payment Systems for Deposits:

- Bank wire transfers

- Credit/debit cards (Visa, Mastercard)

- E-wallets (Skrill, Neteller, Perfect Money)

- Local online banking solutions

- Cryptocurrencies (Bitcoin, Ethereum, Litecoin)

Fast and Automated Transactions:

- Deposits are processed instantly or within 1 business day

- Withdrawals are processed within 1-5 business days

- No delays or manual interventions required

Free Deposits and Withdrawals:

- M4Markets does not charge any fees for deposits or withdrawals

- Third-party payment processor fees may apply in some cases

Customer Support at M4Markets

Multiple Communication Channels:

- Live chat (available 24/5)

- Email support ([email protected])

- Phone support (+248 463 2013)

- Callback request form on the website

Round-the-Clock Assistance:

- Customer support is available 24 hours a day, 5 days a week

- Support is offered in multiple languages, including English, Arabic, and Chinese

Client Reviews on M4Markets Customer Support:

Aspect | Average Rating | Description |

Responsiveness | 4.2/5 | Agents typically respond within a reasonable timeframe, but some delays have been reported during peak hours. |

Knowledge | 4.5/5 | Support staff are generally knowledgeable about the platform, products, and policies. |

Helpfulness | 4.1/5 | While most queries are resolved satisfactorily, some clients have reported difficulties with more complex issues. |

Language Support | 4.7/5 | M4Markets offers support in multiple languages, which is appreciated by its global client base. |

FAQ

Yes, M4Markets is regulated by multiple authorities, including the Financial Services Authority (FSA) of Seychelles, the Cyprus Securities and Exchange Commission (CySEC), the Dubai Financial Services Authority (DFSA), and the Financial Sector Conduct Authority (FSCA) of South Africa.

M4Markets provides access to the MetaTrader 5 (MT5) platform, as well as its proprietary web-based trading platform, WebTrader. Both platforms are available for desktop, web, and mobile devices.

No, M4Markets does not charge any fees for deposits or withdrawals. However, third-party payment processor fees may apply in some cases, depending on the chosen payment method.